India is one of the growing digital markets owing to its increase in the internet user base. The eCommerce market in India for the year 2020 will cross the $64 billion mark. Not only that, but India’s digital economy is growing day by day. Also, Statista forecasts that the eCommerce market will grow to $200 billion by the year 2027.

It is estimated that India will have around 2.2% global market share of digital payments by the year 2023. To conduct such kinds of transactions, service providers need strong, secure, and user-friendly payment gateways in India. Since digitization is getting stronger day by day, most people have favored credit & debit cards, net banking, digital wallets, or other online payment methods in India.

Before we get into the top 10 payment gateways in India, let’s quickly go through the things to consider for selecting the best Indian payment gateway.

- Look for payment gateway charges in India

- Time to set up the gateway

- User interface

- Options for payment

- Support after-sale

Top 10 Payment Gateways in India

The new-age start-ups and small businesses need the best yet cheapest payment gateway in India. Thus, we have come up with a list of payment gateways in India. Each payment method in this list is unique and we cannot call any of these online payment methods in India the ultimate best. In the below list, most payment gateway India no setup fee.

1. CCAvenue

CCAvenue is one of the best payment gateways in India that provides service providers like eCommerce owners with a gamut of payment options. It is fast, safe, and user-friendly as well. Launched in 2001, CCAvenue has improved over the years and has become the slowest to fastest to complete the activation process. They claim it to be within 24hrs nowadays.

CCAvenue offers 200+ online payment methods for end-users to transact hassle-free. It has multicurrency (27major currency), multilingual, ease of customization, retry option, and other features. Also, they have built the FRISK (Fraud and Risk Identification System & Knowledge). And the best thing about CCAvenue is, it’s free to withdraw funds. Air Asia, Lakme India, and Myntra are a few known brands that use CCAvenue.

|

PROs |

CONs |

| Fast Activation Process | Support is not on par. |

| 200+ Payment Options | |

| Zero Set up cost | |

| Recurring Payment Option | |

| Fraud Detection System |

Pricing – (Fees & Charges)

- Zero setup cost.

- RS 1200 maintenance charge

- 2% for credit & debit cards (domestic), Credit card EMI, wallet transaction, UPI, IMPS, Net banking

- 3% credit & debit cards (International) and corporate/commerce credit cards (Domestic)

- Other charges + GST

2. PayU (Formerly PayUMoney)

PayU is a Netherland based online payment proving fin-tech company operational in 17 countries including India. The company rebranded PayUMoney as PayU gateways for consumers. It has an easy sign-up process and small businesses can start accepting payments with minimum efforts. Due to their quick onboarding process, service providers can start accepting payments securely and seamlessly within minutes.

PayU offers 100+ ways of paying money for customers to choose from. They accept major domestic and international credit & debit cards, 75+ net banking options, 100+ UPI bank support, 15 wallet support, and EMI options. The thing that makes it most special is that it offers buy now pay later with Lazypay EMI & Ola Postpaid.

|

PROs |

CONs |

| 100+ Payment Methods | Support is not so great. |

| Easy Sign-up & Activation | Some users experienced delayed payments. |

| Buy Now Pay Later Option | |

| 100+ Foreign Currency | |

| Recurring Payment Option |

Pricing – (Fees & Charges)

- 2%+GST on each transaction from credit & debit cards, wallet transaction, UPI, Net banking, etc.

- 3%+GST for American Express & Diners cards for International transaction & EMI options.

3. Paytm

Paytm has become one of the prominent and best payment gateways in India for small businesses regardless of online or offline. Due to the accessibility and popularity of Paytm, it is one of the most common & cheapest payment gateways in India. Paytm is often the first choice for online consumers for making payments because of its easy-to-use interface.

The Indian payment gateway from Paytm supports the majority of domestic/international debit & credit cards as well as over 50 banks. It has support for 72+ currencies. Withdrawals are generally quick on the same day or within 2-3 days from the transaction date. It also has features such as payment in monthly installments, convenience fees, gift vouchers, and others.

| PROs |

CONs |

| Support for all domestic & international credit & debit cards | Verification requires visiting physical offices |

| Supports over 50 banks | Customer support can be improved |

| 72+ Currencies Supported | |

| Online as well as offline POS system | |

| Real-Time Bank Settlements |

Pricing – (Fees & Charges)

- Zero Setup & maintenance cost as of now.

- 1.99%+ GST per transaction through Paytm wallet, credit cards, & net banking.

- 2.8% for international debit and credit cards.

- 0% on Rupay Debit cards, and 0.4 to 0.9% on Mastercard & Visa.

4. EBS

EBS is an ISO certified payment gateway offered by the France-based Ingenico Group which is a global leader for providing payment solutions. EBS is here for a long time and has improved a lot, which makes it one of the reliable payment gateways in India for small businesses & start-ups.

EBS offers 100+ payment options incorporating 6 credit card brands, 73 debit cards, 8 prepaid cards/wallets, 50+ net banking, and 8+ bank EMI options. It is ISO 27001-2013 certified and achieved the PCI DSS 3.0 standard compliance. Thus, it becomes the best payment gateway in India if you are looking for the most secure payment gateway for your website.

|

PROs |

CONs |

| Supports 100+ Payment Options | Support is not on par |

| ISO Certified Payment Gateway | Lags in UPI payment options |

| PCI DSS 3.0 Compliant | |

| Quick Settlements | |

| Minimum Time for Activation |

Pricing – (Fees & Charges)

- Zero Setup cost as of now.

- RS 1200 maintenance from 2nd

- 2% of credit cards, debit cards, & Net banking.

- 3% for Amex, ezeClick, JCB, wallets, & others.

- RS 7 per transaction towards Advanced Fraud Management Services on international card transactions.

5. PayUbiz

You might be confused between PayU and PayUbiz. Yes, they are both independent entities now and managed by a single company, PayU India. PayUbiz however, is made for large scale businesses & enterprises that need more streamlined & best payment gateway. The PayU on the other hand is more suitable for SMB businesses.

PayUbiz offers vast options for customers to choose from. 6+ credit cards, 45+ net banking, 8 EMI options, 13+ currency processing, payment on IVR, and international card acceptance are few highlights of its payment options. This payment gateway in India is focused on delivering exceptions mobile experience to users. Also, PayUbiz provides deep analytical insights into your data.

| PROs |

CONs |

| Large Range of Payment Options | Some customers experience not on par service. |

| Mobile Focused Indian Payment Gateway | |

| Exceptions Payment Experience | |

| Deep Analytic Data | |

| IVR Payment Stack |

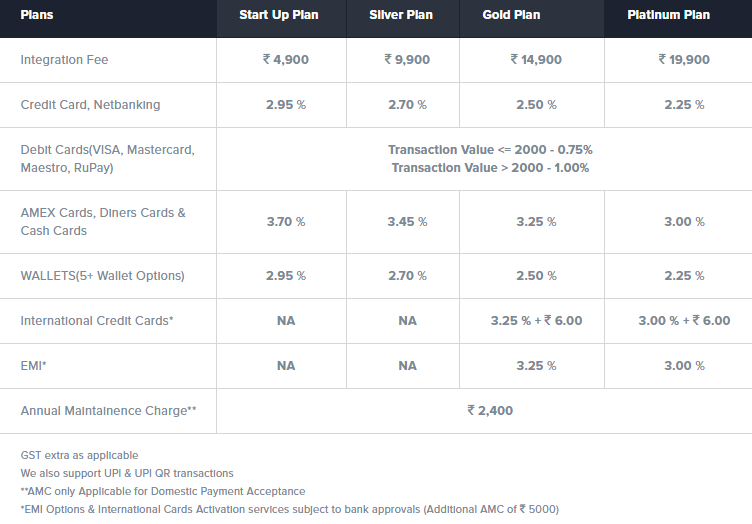

Pricing – (Fees & Charges) – PayUbiz offers 4 plans and charges for each varies as shown in the image below.

6. Razorpay

Razorpay was founded in 2014 and has garnered over 800k customers to date. It is one of the powerful and popular payment gateways in India. Razorpay offers an intuitive dashboard that shows real-time data of purchase. Razorpay has become the go-to platform for small to large companies and even for freelancers or self-employed due to its instant activation & quick integration process.

Razorpay is the only Indian payment gateway to offer a product suite to allow businesses to accept, process, and disburse payments. This makes it the best payment gateway in India. Also, it incorporates all kinds of payment modes such as credit cards, debit cards, 50+ net banking options, UPI, 9 wallets, credit, debit, and cardless EMI options, and others.

|

PROs |

CONs |

| 100+ Payment Options | The failure rate is high on International transactions. |

| Fast Activation & Easy Integration | |

| Zero Setup Charge | |

| Intuitive Dashboard | |

| 24/7 Support System |

Pricing – (Fees & Charges): The Standard plan has the following charges.

- Zero setup & maintenance cost

- 2% per transaction on domestic credit, debit, net banking, UPI, & wallets.

- 3% per transaction on International, Diners, and Amex cards, EMI, and corporate credit cards.

7. Cashfree

Another in our list of payment gateways in India is Cashfree. Cashfree is one of the best yet cheapest payment gateways in India. Started in 2015, Cashfree now has over 15k businesses that benefit from its best payment gateway solutions. It has garnered big names such as BigBasket, HDFC Ergo, Xiaomi, and others.

This Indian payment gateway offers 100+ payment options to end-users to choose from. The payment options include all major credit & debit cards, 65+ net banking options, UPI, Paytm & other wallets, EMI, and pay later options. Also, Cashfree offers international payments in 30 currencies. The one best feature Cashfree has introduced is the instant fund settlement within 15 min of payment capture.

| PROs |

CONs |

| 100+ Payment Modes | Prefers Government registered businesses. |

| Fast Fund Settlement within 15 min. | |

| Instant Refund Facility | |

| Cheapest Payment Gateway In India | |

| No Setup cost |

Pricing – (Fees & Charges)

- Zero setup & maintenance cost

- 1.75% per transaction on domestic credit, debit, net banking, UPI, & wallets.

- 2.5% for Pay later & cardless EMI.

- 3.5% + RS 7 per transactions on International cards.

- 2.9% on Diners, and American Express cards.

8. Instamojo

Next up in our list of top 10 payment gateways in India is Instamojo. As we said that the list is ordered randomly but each payment gateway is unique on its own. Started in 2012, Instamojo is another Indian payment gateway with over 1 million active customers. The lower position of the Instamojo on this list does not affect the popularity of it. It is commonly the first choice of many business owners.

Instamojo has included a wide variety of over 100+ payment methods. It is one of the PCI DSS compliant payment gateways in India. The best thing about Instamojo is that it takes no charge for NEFT/RTGS or bank transfer. Also, it allows merchants to build their own online store with products. Instamojo allows merchants to charge a convenience fee to their customers.

|

PROs |

CONs |

| Supports 100+ Payment Methods | Multicurrency payments are not supported. |

| Easy Integration of Web & App | The live chat feature is not that great. |

| Allows Sharable Links for Payments | |

| Live Chat Facility | |

| Option to Collect Recurring Payments |

Pricing – (Fees & Charges)

- Zero setup & maintenance cost

- Free NEFT/RTGS or Bank transfers for 60+ banks.

- 2% + RS 3 per transaction on domestic credit/debit cards, net banking, UPI, & wallets.

- 3% + RS 3 per transactions on American & other international cards.

9. PayPal

PayPal is not only a reputed payment gateway in India but also a globally recognized payment option. It has over 346m active user accounts in over 200 countries. Just by integrating this payment method on your website checkout, the chances of customers buying the products increase by 54%.

PayPal offers world-class security for transactions taking through its gateway. Due to the global brand, PayPal supports almost all credit & debit cards and has support for 100 currencies to make a withdrawal. Also, PayPal offers a 24/7 real-time fraud protection system. It is a one-stop solution for Indian merchants who need a robust international payment gateway. Their simple and transparent fees make them one of the best payment gateways.

|

PROs |

CONs |

| Supports all major credit/debit cards | Not good for small transactions as the fee is high |

| 24/7 Support & fraud monitoring | |

| 100 Currencies support | |

| Fast & secure payment option | |

| Payment through QR |

Pricing – (Fees & Charges)

- Zero setup & maintenance cost

- 2.5% + RS3 for domestic payments.

- 4.4% + fixed currency fee for international payments.

10. Paykun

Last but not least on our list of payment gateways in India is Paykun. Paykun is one of the emerging cheapest payment gateways in India. It is designed with speed and ease from onboarding to integration to receive payments. The Indian payment gateway providers have grown the capabilities of it for small to even large businesses and enterprises, freelancers, YouTubers, bloggers, etc.

Paykun offers 120+ payment methods to choose from. It comes with the lowest transaction charges, payment link generation option, PCI DSS compliance, and others to make transactions fast and secure. Also, it has an instant fund settlement on select payment modes. Paykun is available on email, call, or chat to assist merchants if they run into any problem.

|

PROs |

CONs |

| Supports 120+ Payment Options | Lags Behind in Support |

| Payment Link Generation Feature | POS support not available. |

| World-Class Security | |

| Fast Fund Disbursal | |

| Accepts International Payments |

Pricing – (Fees & Charges)

- Zero setup & maintenance cost

- 1.75% per transaction for domestic debit cards, net banking, UPI, and wallets (Except Paytm)

- 2% per transaction on domestic credit cards and Paytm wallet.

- 3% per transaction on international credit cards, Diners/Amex cards, and JCB.

Summing Up

So, these were our top 10 payment gateways in India list. When it comes to selecting the best payment gateways for Indian people, merchants most usually go with Razorpay or Instamojo. Hope you guys have enjoyed this list of Indian Payment gateways.

Want advice from experts on what payment gateway to choose? Consult our experts to make a more informed decision to grow your business by integrating the best payment gateway in India.